Those watching the United States space sector will have begun to take for granted commercial companies doing some pretty unprecedented things such as ferrying astronauts to/from the ISS, planning asteroid mining missions, space farming, or manufacturing in space. With SpaceX having set the gold standard for commercial crewed and cargo spaceflight, and with companies like Asteroid Mining Corporation and Deep Space Industries having been planning asteroid mining missions for almost a decade, commercial space exploration in the west is a relatively mature–if still very nascent–sector.

In the case of China, commercial space exploration is more limited. Due to a combination of factors, namely the earlier stage of the Chinese space sector, and the dominance of SOEs in sub-sectors such as space exploration, China does not, at least to now, have a “Chinese version of SpaceX” that can launch taikonauts and cargo to the space station.

But this is beginning to change, with a handful of companies beginning to emerge, and perhaps more surprisingly, a number of government indicators that seem to show an openness to commercial space exploration missions. In 2022 and beyond, this is likely to pick up steam, and we may yet see a commercial Chinese company ferrying people (or more likely cargo) to/from the space station sooner rather than later.

Space Exploration in China

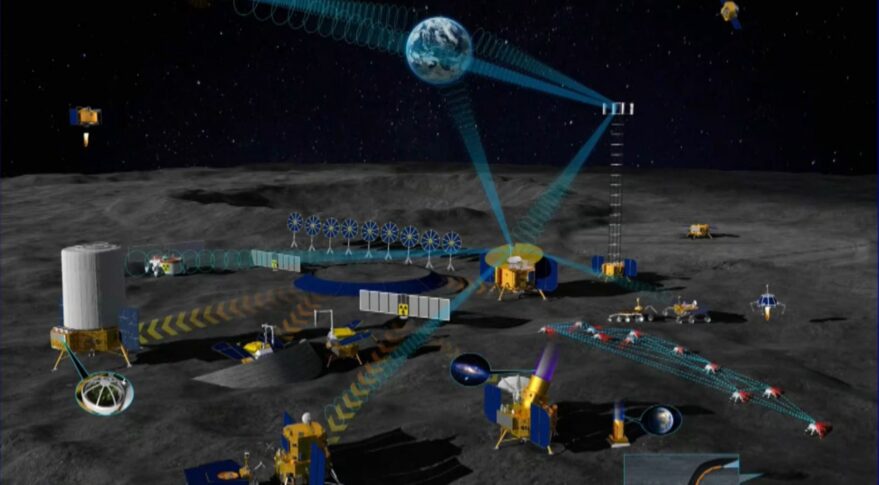

If we consider space exploration at a high level, we could be talking about several things. For the purposes of this article, we will be referring to the Chinese Space Station, Lunar/Mars missions, commercial space science, and asteroid missions. In the case of China, space exploration, in general, is a pretty recent concept: the first mission beyond the Earth’s orbit was in 2007 with Chang’e 1 lunar orbiter, and the first Chinese space station prototype, the lightweight Tiangong-1 (~8500 kg), was launched in 2011.

That being said, despite China’s late start to space exploration, we have seen a rapid acceleration, with an increasingly narrow gap between China and some of the leading space nations. Since the launch of Tiangong-1, China has launched two more space stations (the experimental Tiangong-2 and the permanent Chinese Space Station), and since the Chang’e-1, China has launched 4 more lunar missions (Chang’e 2-5). In the meantime, China also reached Mars in 2021 with the Tianwen-1 mission, become along the way the second nation to ever successfully land a rover on the Red Planet. Worth noting, an important enabler for these large-scale space exploration missions has been the entry into service of heavy-lift rockets (the Long March 5 and 5B).

This pile of projects has led the China Aerospace Science and Technology Corporation (CASC, the main state-owned space contractor) to having a pretty full plate. The company conducted 48 launches in 2021, putting into orbit dozens of remote sensing satellites, a handful of large GEO commsats, various space science satellites, and of course the Tianhe-1 core module of the Chinese Space Station. This has opened the door for more commercial involvement in China’s space exploration sector.

The Beginnings of Commercialization

Over the past year or so, we have seen a small but increasing number of examples of commercialization in China’s space exploration missions. The first rumblings came about in early 2021, when we saw the China Manned Spaceflight Agency (CMSA) make an announcement calling for diversification of cargo supply mechanisms for the Chinese Space Station, and in particular calling for the establishment of a “low-cost cargo transport method”.

The announcement came just a few months before the launch of Tianhe-1, and included specifications from CMSA for the low-cost cargo spacecraft, including:

- Payload capacity of 1-4 tons

- Cargo should be delivered within 45 days of validation of payload

- The cargo spacecraft must be able to de-orbit a payload of 100-300kg of waste in a controlled manner

- Costs for the spacecraft need to be aligned with international standards.

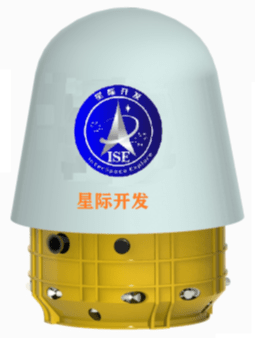

The low-cost commercial cargo spacecraft dreams of the CMSA may have started to be answered in August of last year, when Chinese commercial startup Interspace Explore (北京星际开发) raised tens of millions of RMB in an angel round of funding. The company was actually founded back in 2018, but apparently began developing a prototype of its Zengzhang-1 spacecraft at the beginning of 2021, around the same time as the aforementioned CMSA announcement. The timing may have been coincidental, but it seems possible that Interspace Explore was encouraged by the announcement for low-cost cargo spacecraft (besides, how many other buyers of the Zengzhang-1 might there even be in China in the short-medium term?).

Interspace Explore has some pretty big ambitions for the Zengzhang-1, and some pretty high expectations for commercial cargo transport demand more generally. The company’s Zengzhang-1 is designed to carry 350kg of cargo to the CSS, and return 100kg, and they expect demand to be 5-10 missions per year of carrying cargo down from the CSS, starting in 2022. The company plans for a test of their Zengzhang-1 this year, having signed an agreement with Galactic Energy in August 2021 for launch services. Their faith in Galactic Energy seems to have been rewarded with Galactic Energy’s successful 2nd launch of the Ceres-1 in late 2021, several months after the agreement with Interspace Explore.

Interspace Explore’s customers include companies planning space pharmaceutical and space agriculture applications, and their funding round included financing from Innoangel Fund, a significant VC that has put money into a variety of space companies including Space Pioneer (aka Tianbing Aerospace) and Spacety.

Other initial areas of commercialization involving LEO exploration include space medicine and agriculture. Rocket Pi, a latecomer to the launch sector having been founded in 2021, is developing its Darwin-1 rocket with biology experiments in micro-gravity in mind as a major end market.

Mining Commercial Companies for Innovation

Space mining is one of the more far-off, but potentially strategically important areas of commercial space exploration. A variety of companies in the west have been developing hardware to mine valuable resources from asteroids, with this having been a small but growing trend for some time.

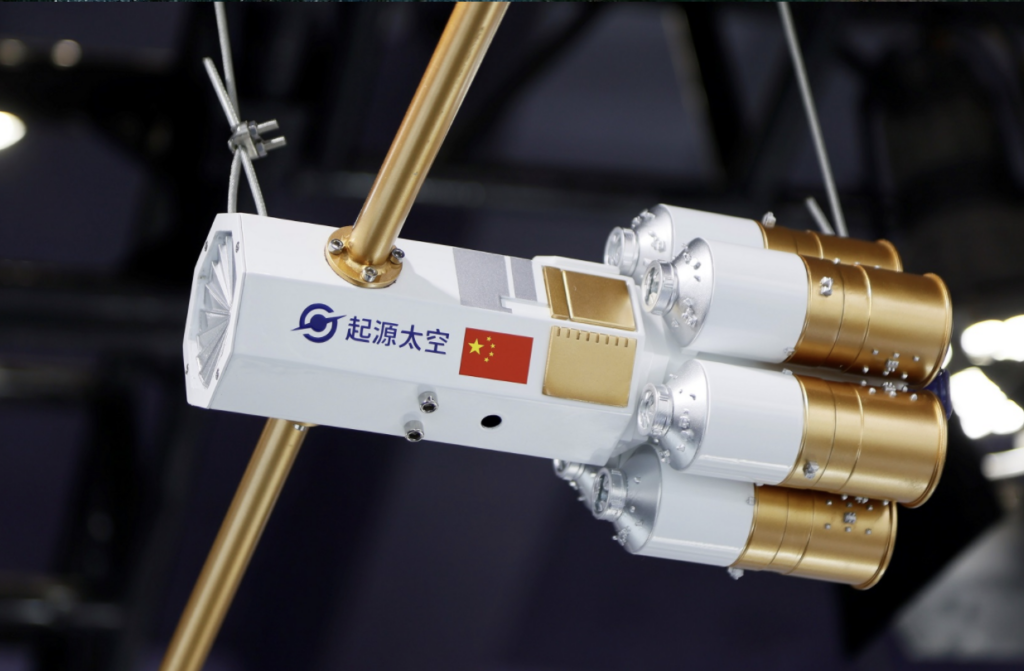

In China, it has been more recent, with the first commercial space mining company, Origin Space (起源太空), having raised its first round of funding in 2019. The Shenzhen-based company hopes to lead China’s space mining efforts in a market that they see as important for China to win its share of. The CEO of Origin Space Yu Tianhong, noted that the goal of Origin Space is for China to not be left behind in the battle for space resources.

The company has already launched a few satellites and spacecraft, most notably its NEO-01, in April 2021. Up to now, these spacecraft aim at surveying asteroids around the solar system, trying to identify those of interest for future mining activities. In the meantime, however, there has been some interesting commercialization going on, with the company selling its asteroid scanning data to other companies that might be interested in using it for a variety of purposes, including gathering information for asteroid mining.

Origin Space’s founding team is one of China’s most impressive, with the two co-founders having done a PhD in Astrophysics at Harvard, and an Earth Science Fellowship at NASA, respectively. The two co-founders are relatively young, and have access to some of China’s top VCs.

Moving forward, Origin Space also has plans for cleaning up space junk, developing asteroid defense technology, and harnessing asteroids, bringing them back to the Earth’s vicinity, and harvesting their resources. In short, quite a list of things that, as recently as just a few years ago, would have been unquestionably state-run in the Chinese context.

The Future of China’s Commercial Space Exploration

In just a couple of decades, China has gone from effectively no presence in space exploration to being one of the world leaders, led by a large and comprehensive state sector. But just as the west began to see commercial space exploration companies begin to flourish a decade or more ago, China has begun to see the emergence of a nascent commercial space exploration sector.

The next few years are certain to see growth in China’s space exploration ambitions, with the country’s recent 2021 Space White Paper outlining some major projects, and with ambitious plans in CASC’s pipelines for bigger rockets that could enable larger-scale space exploration. At the same time, literally, dozens of launch companies have emerged, with some of them close to the point of offering launch services. A variety of cities and companies have developed satellite manufacturing industrial bases, with the goal of industrializing and commercializing space technologies.

All of these things will continue to drive down the price of access to space, and an increase in the possibilities for commercial space exploration. Companies like Origin Space and Interspace Explore are leading the charge for China’s commercial space exploration sector, but they are certain to not be the last ones entering the fight.